When searching for a space to lease, an applicant may not be thinking of his/her landlord as a university. However, efforts to invest in and maximize real estate revenue are becoming more common among colleges and institutions of higher learning.

A 2013 study by the National Association of College and University Business Officers (NACUBO) and Commonfund Institute found that institutions on average invested 7% of endowment funds in non-campus real estate.

Ivy league universities have received particular attention for their sizable real estate holdings. Yale is currently New Haven’s largest landlord, and Princeton University owned 325 properties as of February 2020.

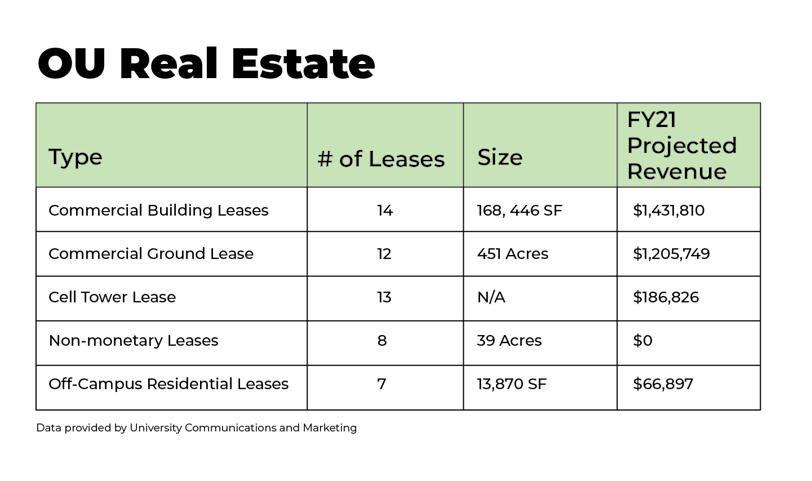

While Ohio University’s real estate portfolio is not on scale with those of the Ivy League universities, real estate generated income is revenue that factors into the school’s yearly budget. OU’s office of real estate currently manages a total of 54 non-campus leases, composed of commercial building, commercial ground, cell tower, non-monetary and off-campus residential leases.

Though its real estate holdings are relatively minor in 2021, real estate revenue was one of the original sources of income for the university.

The adjacent townships of Athens and Alexander were originally set aside by the Ohio Company of Associates for the establishment of a university, as the Northwest Ordinance of 1787 encouraged schooling and education. When OU was chartered in 1804, a majority of the property in the townships was leased to generate income for the university.

“So, when you talk about real estate, it really was the original source of funding for the university,” Dominick Brook, director of real estate, said.

For the 2021 fiscal year (FY), total projected revenue from OU’s leased holdings is about $2.9 million, which makes up less than 1% of the university’s base operating revenues in its budget, Carly Leatherwood, a university spokeswoman, said in an email. The majority of this revenue is projected to be generated by commercial leases.

“The University has increased the amount of vacant space it is leasing and will increase lease revenue by approximately 5% in FY21. Lease revenue for FY22 is estimated to increase by a further 9%,” Leatherwood said in an email.

The majority of lease costs have remained the same, with the university working on deferred payment plans with several lessees to accommodate decreased resources due to the pandemic, Leatherwood said.

In the future, Leatherwood said the university is interested in projects such as the rehabilitation of several of the historic buildings at The Ridges in Athens, and looking to lease space on Athens’ campus that is currently vacant. The university is also teaming up with the City of Dublin to provide mixed opportunities at OU’s Dublin campus.

“While the University is not a real estate developer, it is looking to partner with private companies and developers to ensure that unoccupied land and vacant buildings are used in a manner that provides the greatest strategic and financial return to the University,” she said in an email.

For more information about development opportunities, visit Ohio University’s website here.